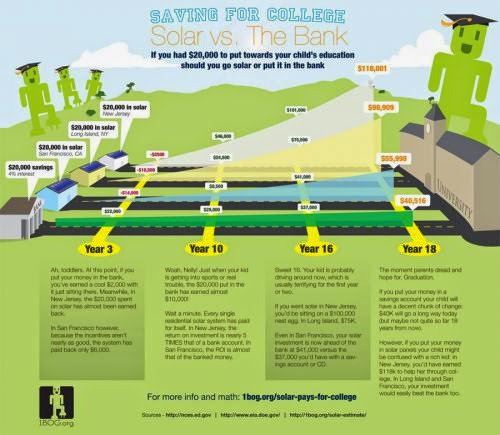

Is Solar A Better Investment Than Putting Money In The Bank

This infographic data makes an interesting point: investing your money in solar energy is a better investment than putting your money in the bank. Okay, that is a little like shooting fish in a barrel. If your investment counselor can't find you a better way to invest your money than to put it in a savings account, then it is probably time to start shopping for a new investment counselor. Especially for something as important as saving for your kids education.Infographic credit: www.1bog.orgLET'S ASSUME THAT WE HAVE 20,000 TO INVEST WHEN OUR LITTLE BUNDLES OF JOY ARE TODDLERS. The first family in the example pushes the stroller to the bank, leaves the 20,000 with nice man behind the counter, who makes a note in their passbook, and then they walk home, knowing that their money is safely earning 4%. Simple math tells them that when the youngster is itching to sneak off to his high school graduation party, that 20,000 will have more than doubled to 40,516, a gain of 20,516. There is no guarantee that 20,516 is going to cover the Class of 2031's meal plan, let alone tuition and books, but it is a respectable start. The other three families invested their 20,000 in a the grid-tied home solar power system, like what we offer here at Pur Solar. They make the same walk to the bank every month, to deposit their savings in the same 4% savings account. The kids probably got tired of making the walk with them pretty quickly, but by the tenth year, while the kids are still young enough to believe in Santa Claus, the solar installations have more than paid for themselves (maybe he does exist).THESE EXAMPLE SOLAR INVESTMENTS VARY, BUT ALL COME OUT AHEAD. Solar economics is a rather regional thing. This has less to do with how many hours of sun your region gets or cloud cover, and more with local politics. In San Francisco, after deducting the federal tax credit and the California rebates, 20,000 buys a nice 6kW Solar power system. Quite respectable, and enough to save our family 147 a month on their power bills. AFTER SOCKING THAT 147 AWAY EVERY MONTH FOR 18 YEARS, JUNIOR'S COLLEGE KITTY IS A RESPECTABLE 55,998.THINGS ARE DEFINITELY MORE INTERESTING ON THE EAST COAST. The rebates are so good in some regions that our Long Island family was able to afford a 12.3kW system with their 20,000. This allowed them to save 230 a month for a college nest egg of 98,909. That does not include the original 20,000 that they have already recouped. New Jersey allows homeowners to collect and sell Solar Renewable Energy Credits (SRECs). The utility companies will buy the SRECs to offset their non-renewable energy production. It means that our New Jersey family HAS 118,001 BY THE CLASS OF 2031'S College Visitation Week.SAVING FOR COLLEGE OBVIOUSLY CAN'T START TOO SOON. This whole exercise supposes that the young family has 20,000 to put in the bank or invest in solar. It is more likely that they are still paying on their own student loans. However, it is probably reasonable to expect that the nice man at the bank will be willing to listen to your thoughts about investing in solar. Contact Travis at Pur Solar & Electrical to discuss how the regional rebates and incentives work out in Northern Arizona. You may want to consider doing this sooner than later, since the future of solar incentives in Arizona are uncertain, to say the least. The post Is Solar A Better Investment Than Putting Money In The Bank? appeared first on www.pursolaraz.com.

0 comments:

Post a Comment